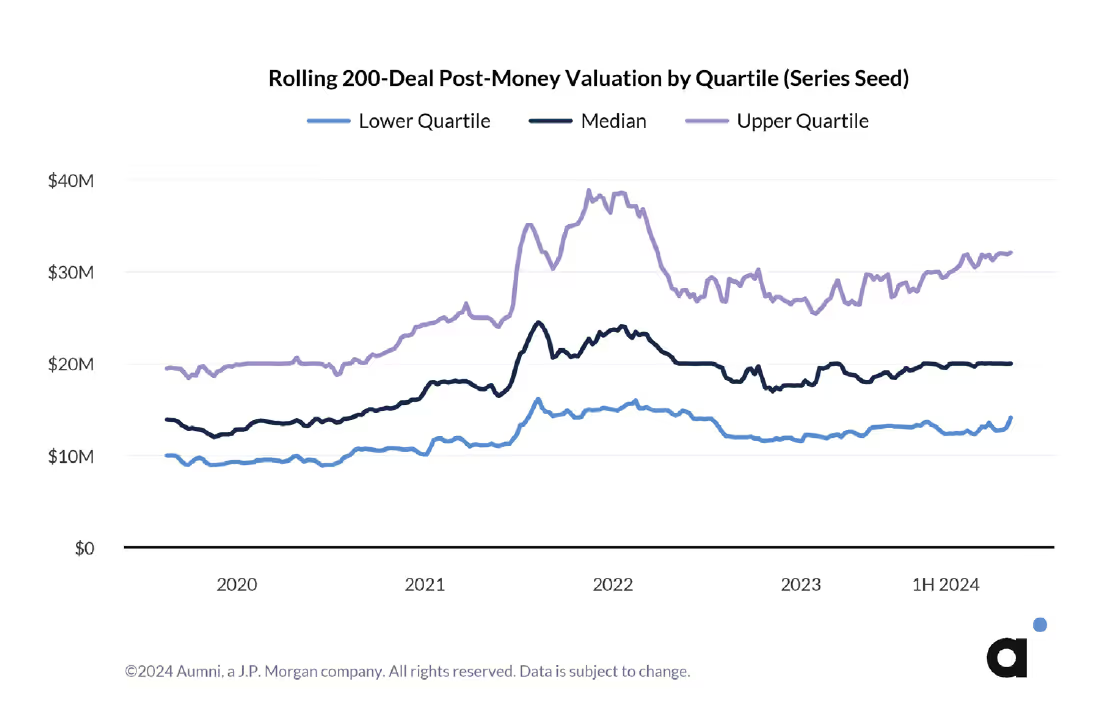

Improvements in valuations led by top-end

We noted in our recently published Aumni Venture Beacon: 1H 2024 Report that there has been a general improvement in valuations in the venture market over the last few months. Interestingly, a deeper look at the interquartile range of post-money valuations reveals that the market shift is occurring at the top quartile of the market.

Across financing stages, there is a clear divergent trend between top quartile valuations, which have seen significant momentum in the first half of the year, and the median and bottom quartiles, which remain relatively flat and unchanged. The headline data that valuations improved, therefore, does not paint the full picture, as the recovery in the first half of the year seems to be mostly driven by the top end of the market. The chart below, which looks at Series Seed, speaks to this trend.

The trend generally holds true across stages. To see how various quartiles are performing across Series A, B, C and D+, see our recent Aumni Venture Beacon: 1H 2024 Report, which covers these developments and much more.

©2023 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC.

This material is not the product of J.P. Morgan’s Research Department. It is not a research report and is not intended as such. This material is provided for informational purposes only and is subject to change without notice. It is not intended as research, a recommendation, advice, offer or solicitation to buy or sell any financial product or service, or to be used in any way for evaluating the merits of participating in any transaction. Please consult your own advisors regarding legal, tax, accounting or any other aspects including suitability implications, for your particular circumstances or transactions. J.P. Morgan and its third-party suppliers disclaim any responsibility or liability whatsoever for the quality, fitness for a particular purpose, non-infringement, accuracy, currency or completeness of the information herein, and for any reliance on, or use of this material in any way. Any information or analysis in this material purporting to convey, summarize, or otherwise rely on data may be based on a sample or normalized set thereof. This material is provided on a confidential basis and may not be reproduced, redistributed or transmitted, in whole or in part, without the prior written consent of J.P. Morgan. Any unauthorized use is strictly prohibited. Any product names, company names and logos mentioned or included herein are trademarks or registered trademarks of their respective owners.

Aumni, Inc. (“Aumni”) is a wholly-owned subsidiary of JPMorgan Chase & Co. Access to the Aumni platform is subject to execution of an applicable platform agreement and order form and access will be granted by J.P. Morgan in its sole discretion. J.P. Morgan is the global brand name for JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. Aumni does not provide any accounting, regulatory, tax, insurance, investment, or legal advice. The recipient of any information provided by Aumni must make an independent assessment of any legal, credit, tax, insurance, regulatory and accounting issues with its own professional advisors in the context of its particular circumstances. Aumni is neither a broker-dealer nor a member of any exchanges or self-regulatory organizations.

383 Madison Ave, New York, NY 10017